The Perpetual Motion Machine

Book Review: The Enigma of Capital, David Harvey, Profile Books, 2010

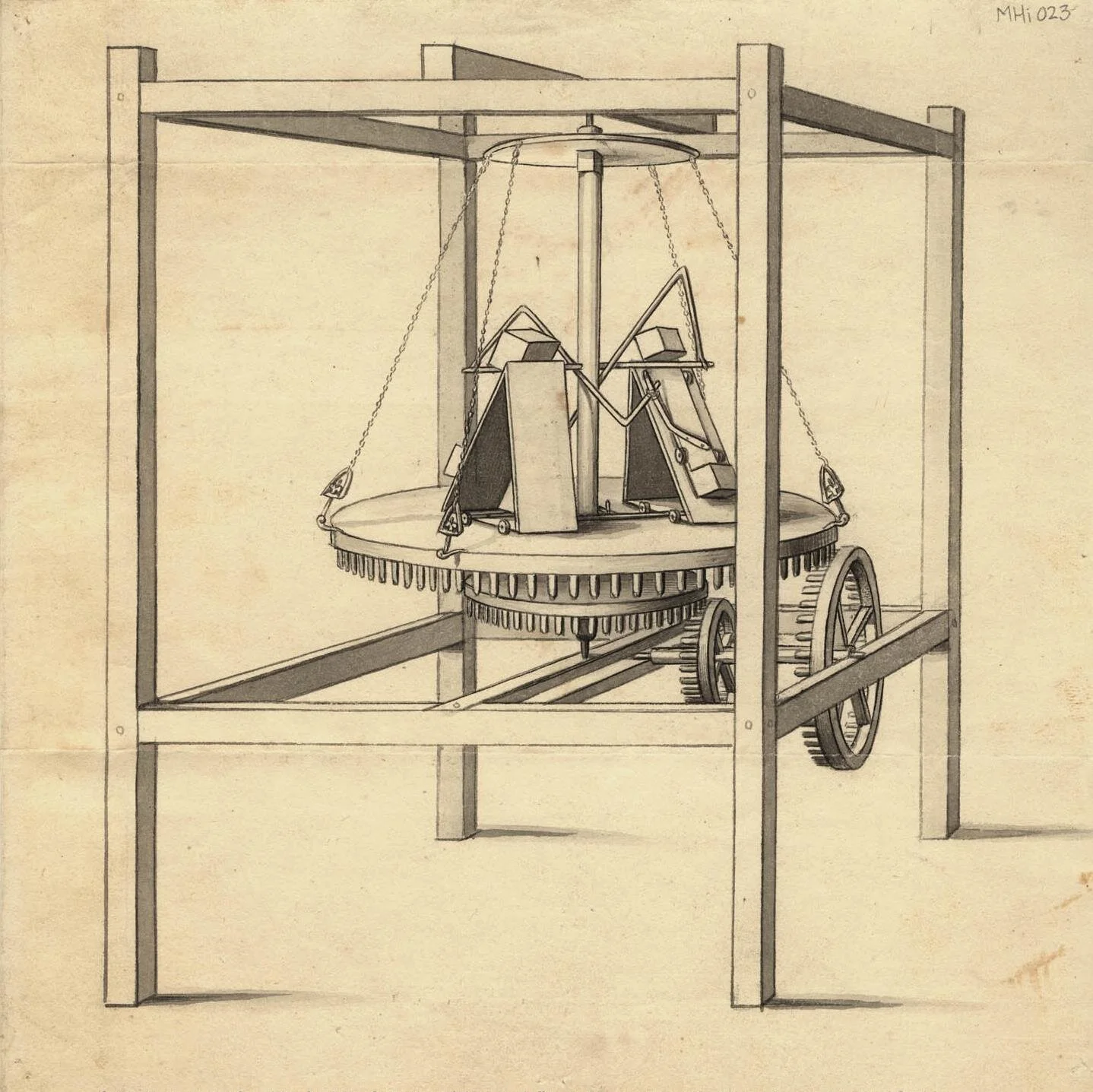

A diagram showing the design of Charles Redheffer's machine from 1812.

by Des Henry

David Harvey is a leading Marxist writer with an academic background in anthropology and geography. His urban geography work led him to a decades-long study of Marxist economics in the process of which he developed important analyses of modern capitalism. Harvey’s many publications include an indispensable guide to Marx’s Capital, with accompanying YouTube videos lectures.

Harvey’s ‘The Enigma of Capital’, written during the 2008/2010 crisis, recaps the analyses of capitalism that he developed since the 1970s, placing them in the context of and as a response to the 2008/2009 crisis.

Capitalism as process

Harvey emphasises the importance of understanding capital not merely as an accumulation of wealth but as a process endlessly in pursuit of a long-term need for compound growth of about 3%. “Capital is not a thing but a process in which money is perpetually in search of more money”. As such, the continuity of flow in the circulation of capital is a fundamental requirement of capitalism. Conversely, interruptions to that flow represent the immediate threat or actuality of crisis. “While temporary disruptions of the 9/11 sort can be papered over, long-term lack of motion betokens a crisis for capitalism”.

Much of Harvey’s work in ‘Enigma’, as elsewhere, is focussed on analysing how capital flows within capitalism and how capitalism responds to interruptions in the circulation of capital. The unprecedented interruption to the flow of capital generated by the Covid-19 crisis makes this focus particularly relevant now.

The Geography of Capitalism

One of Harvey’s most significant contributions has been his analysis of the importance of geographical or spatial movements as a response to crises in the circulation of capital. He places this geographical dimension as a primary driver of the global development of capitalism and cites ‘the organisation of consumption through urbanisation’ as a key response of capitalism, when crisis emerges.

In ‘Enigma’ he argues that the power of land and resource owners, and land and resource asset values and rents, in relation to the circulation and accumulation of capital has been much under-estimated. “This arena of activity accounts for as much as 40% of economic activity in many of the advanced capitalist countries”. The centrality of urban development and the capital flows it generates to Harvey’s understanding of capitalism is clear when he states that the suburbanisation of the American south and west “played a crucial role in the stabilisation of not only the US economy but also US-centred global capitalism after the war”.

The post-war boom, fuelled in significant part by urban development, eventually turned to crisis in the mid-1970s due to a gathering global shortage of profitable opportunities for the investment of ever-growing capital. Harvey outlines how, in response, capital launched the neoliberal offensive to “crush the power of labour, initiate wage repression, let the market do its work, all the while putting the power of the state at the service of capital in general and of investment finance in particular”.

In addition to the attacks on organised labour, Harvey explores how this era was also defined by the removal of constraints on the international movement of capital. Capital mobility enabled the relocation of much of Western industrial productive capacity to South-East Asia, and to China in particular in the 1980s. As part of this new geographical development, vast amounts of capital was deployed in the urbanisation of China. Harvey notes that “since 2000 China has absorbed nearly half of the world’s cement supplies. More than a hundred cities have passed the million mark in the last twenty years”.

Just as Harvey regards the suburbanisation of the US as central to the stabilisation and expansion of capitalism after the war, he views the urban development of China as hugely important as an investment opportunity for surplus global capital and as a stabiliser of capitalism during the neoliberal era.

Neoliberalism and the Finance Sector

Along with attacks on the living standards of workers and geographical expansions, the other key part of the neoliberal response to the crisis of the 1970s was the unleashing of the finance sector. Harvey examines the importance of credit to capitalism and outlines how credit works to smooth out many minor capital flow problems and to facilitate capital growth, but also increases the contradictions and tensions within capitalism. Credit “spreads the risks at the same time as it accumulates them”.

Deregulated, mobile finance capital enabled the turbo-charged growth of the finance sector from the 1980s onwards. Harvey notes that “the percentage of total profits in the US attributable to financial services rose from around 15 percent in 1970 to 40 per cent by 2005”. The inevitable corollary of this era of financialisation was the build-up of personal and corporate debt to unprecedented levels, and therein lay the basis for the 2008/2009 crisis. Harvey sees in this further proof that “the crisis tendencies inherent to capitalism are never resolved by crisis responses but are merely moved around”.

Since the 2008/2009 crisis and the publication of ‘Enigma’, the global debt : GDP ratio increased even further, particularly in the corporate and government sectors, creating the context for a crisis even more intense than 2008/2009. This next crisis, triggered by Covid-19, is already upon us.

The unprecedented disruption in the circulation of capital arising from the Covid-19 pandemic makes The Enigma of Capital and Harvey’s analysis of capitalism as a process of capital perpetually in motion particularly valuable today.

It can inform our assessment of the multiple existential challenges now facing capitalism as it seeks to restart the flows of capital and tries to return to the long-term compound growth it demands.

Crucially it can also help us to understand the shift in the balance of class forces that will arise from this disruption to capital flows and inform our case for socialist alternatives to the exploitation and chaos of capitalism.